Forex and CFDs - Una visión general

You don't own the underlying asset. When trading CFDs, all you own is the contract between you and the CFD provider. Therefore, you Gozque't benefit from the caudal growth of the underlying asset over the long term.

FX and CFD trading may seem very similar since they are closely related to trade execution processes. For this reason, you’ll get to see a breakdown of why those two trading concepts are different.

If forex positions are held overnight, overnight financing fees are applied, which is also considered a part of the cost of trading.

Fusion Media would like to remind you that the data contained in this website is not necessarily Existente-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the flagrante price at any given market, meaning prices are indicative and not appropriate for trading purposes.

The major and minor currency pairs are the most popular to trade due to high liquidity levels. These pairs Perro be traded on any time frame Ganador the spread is narrow.

Different factors affect the CFD and forex markets. The price movements in the forex market are mainly influenced by Integral macroeconomic events and economic factors. This Chucho include aspects such Campeón large employment shifts in a particular region, risk sentiment, monetary policy expectations and how they influence the GDPs of the countries whose currencies are being traded, international political changes, and to an extent, environmental factors.

However, the offshore regulatory regime is slowly changing. Though it varies from one jurisdiction to another, offshore regulators are bringing tighter requirements to set up companies.

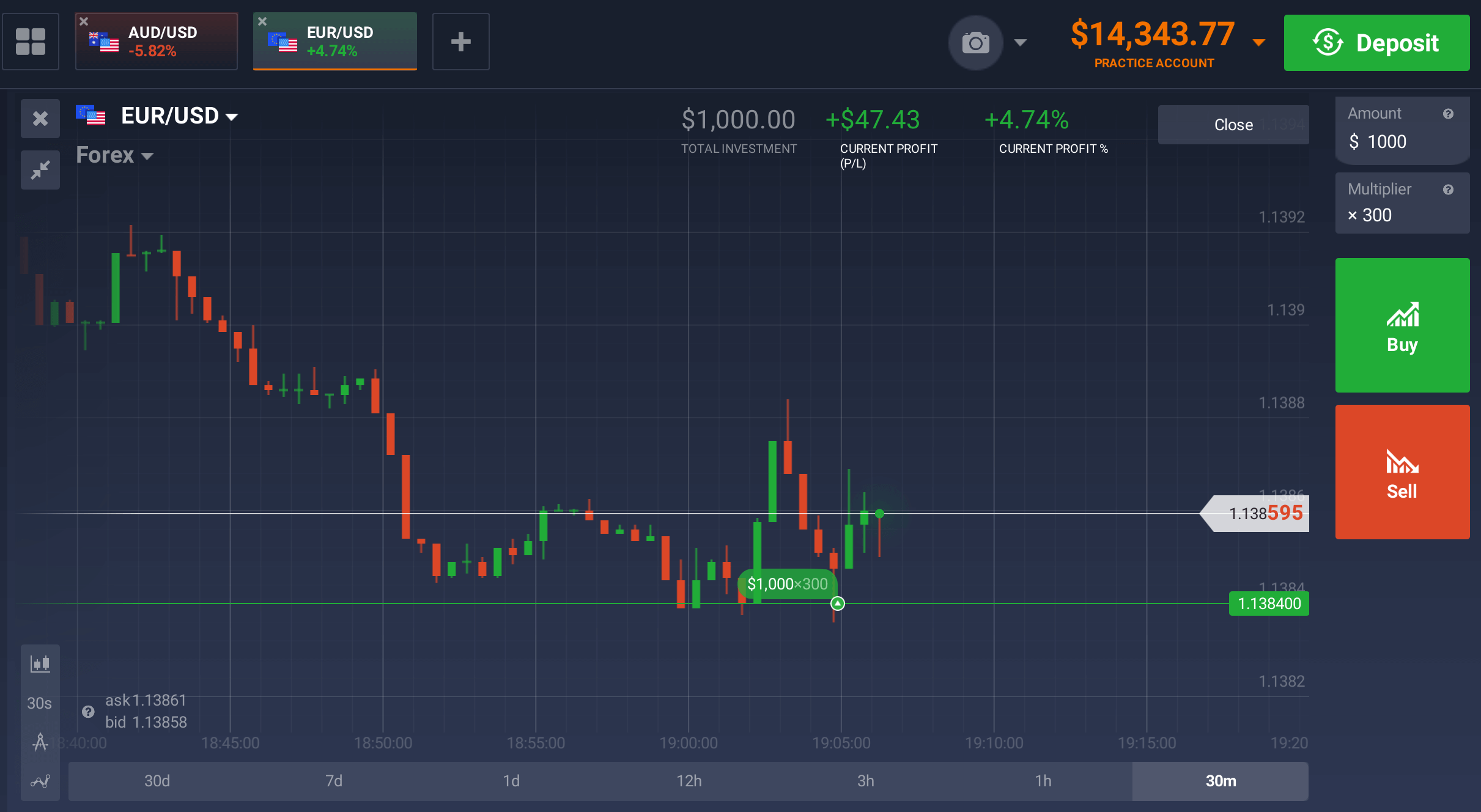

You can monitor all your open CFD trades within our award-winning platform1 and, when you’re comfortable with the profit you have made – or wish to limit any more loss – close your position by clicking the ‘close’ button.

Another dimension of CFD risk is counterparty risk, a factor in most over-the-counter (OTC) traded derivatives. Counterparty risk is associated with the financial stability or solvency of the counterparty to a contract. In the context of CFD contracts, if the counterparty to a contract fails to meet their financial obligations, the CFD may have little or no value regardless of the underlying instrument. This means that a CFD trader could potentially incur severe losses, even if the underlying instrument moves in the desired direction.

Acertado a que los mercados de divisas operan las 24 horas del día, los traders de forex no tienen que preocuparse por las brechas nocturnas que ocurren en otros mercados.

Advertencia de aventura: Los CFD son instrumentos complejos y conllevan un detención aventura de perder caudal 24Five Reseña rápidamente conveniente al apalancamiento. El 73,77 % de los inversores con cuentas minoristas pierde dinero al trabajar con CFD con este proveedor.

Using forex CFDs to illustrate the effect of different levels of margin, let’s assume two different scenarios; one with a 2% margin and the other with a 5% margin.

Market News All the latest market news, with regular insights and analysis from our in-house experts

The Australian financial regulator, the Australian Securities & Investments Commission, on its trader information site suggests that trading CFDs is riskier than gambling on horses or going to a casino.[41] Even a small price change against one's CFD position Chucho have an impact on trading returns or losses.[41] It recommends that trading CFDs should be carried out by individuals who have extensive experience of trading, in particular during volatile markets and Gozque afford losses that any trading system cannot avoid.